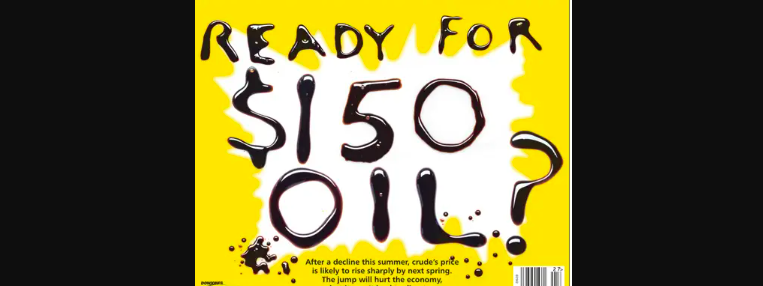

$150 Oil Is Still A Distinct Possibility

The European Union seems to be warming to the idea of direct sanctions on Russia’s energy industry, slapping a ban on imports of coal for starters. The United States is releasing 180 million barrels of crude, and several IEA members are releasing another 60+ million barrels. And Saudi Arabia just hiked its prices for all buyers. Much higher oil prices may be around the corner.

When a few months ago analysts were seemingly trying to out-forecast each other on crude oil prices, the most commonly cited bullish factors were OPEC+’s unwillingness to boost production by more than originally agreed while demand for oil continued strong.

Now, all the news appears to be on the war in Ukraine, and the main bullish factor for oil is the expected continued decline in Russian oil exports. The country is the largest exporter of crude oil and oil products and a big supplier to the European Union, which explains the EU’s reluctance to directly target its energy industry. Yet pressure is growing on Brussels to do just that, and with coal already on the sanction list, it’s probably only a matter of time before oil becomes a target, too. When this happens, Brent may well top $120 and stay there.

In the meantime, the United States has publicly stated it had banned all Russian oil and fuel imports, but in fact, the ban is only coming into effect on April 22, and in the meantime, the U.S. is stocking up on Russian oil and products.

Source: OilPrice

Leave a Reply

Want to join the discussion?Feel free to contribute!